Introduction:

Jing Wang, the chairman and CEO of FinTell, said "2022 will be the beginning of a new era of the Chinese FinTech market ".

Jing used to be the CRO of Baidu Finance. Prior to Baidu, he had worked at American Express for 17 years. His last job at American Express was senior vice president of the Enterprise Model Validation Group responsible for model risk management globally at American Express. Starting from his rich experience in risk management at home and abroad, Jing believes that the new trend of the industry is an inevitable evolution under the laws and regulations of industry supervision, and it is also a reflection of regulators’ intention in the continued development of the industry.

(Note: The Fintech discussed in this article specifically refers to Fintech in the fields of consumer finance, retail credit and small and micro credit.)

The Fintech industry has undergone tremendous changes in the past five years. As the founder of FinTell, I have witnessed this period of rapid development. Fortunately, with the efforts and support of our employees and partners, we have grown from zero to be a company serving hundreds of licensed financial institutions.

To help the key participants in the industry better comply with regulatory requirements, expand businesses, develop products, serve customers, and manage risks in the new phase of the industry, I would like to share some of my thoughts and views on the trend in 2022. Hope it is helpful.

2022 will be the new era of Chinese FinTech market

The reason why I think so is that 2022 will be the first year when the "new regulations" will be substantially implemented, the year when the "new trends" will be fully reflected, and the year when the "new models" will be formed in the Fintech ecosystem.

These new regulations, new trends and new modes have never been seen or experienced in the domestic Fintech industry in the past ten years. So, whoever can "feel" the "pulse" of the new era and fully embrace these regulations, actively adapt to the trends, and vigorously innovate in the new models, will establish a competitive advantage in 2022, a year full of both challenges and opportunities.

The background of 2022 development

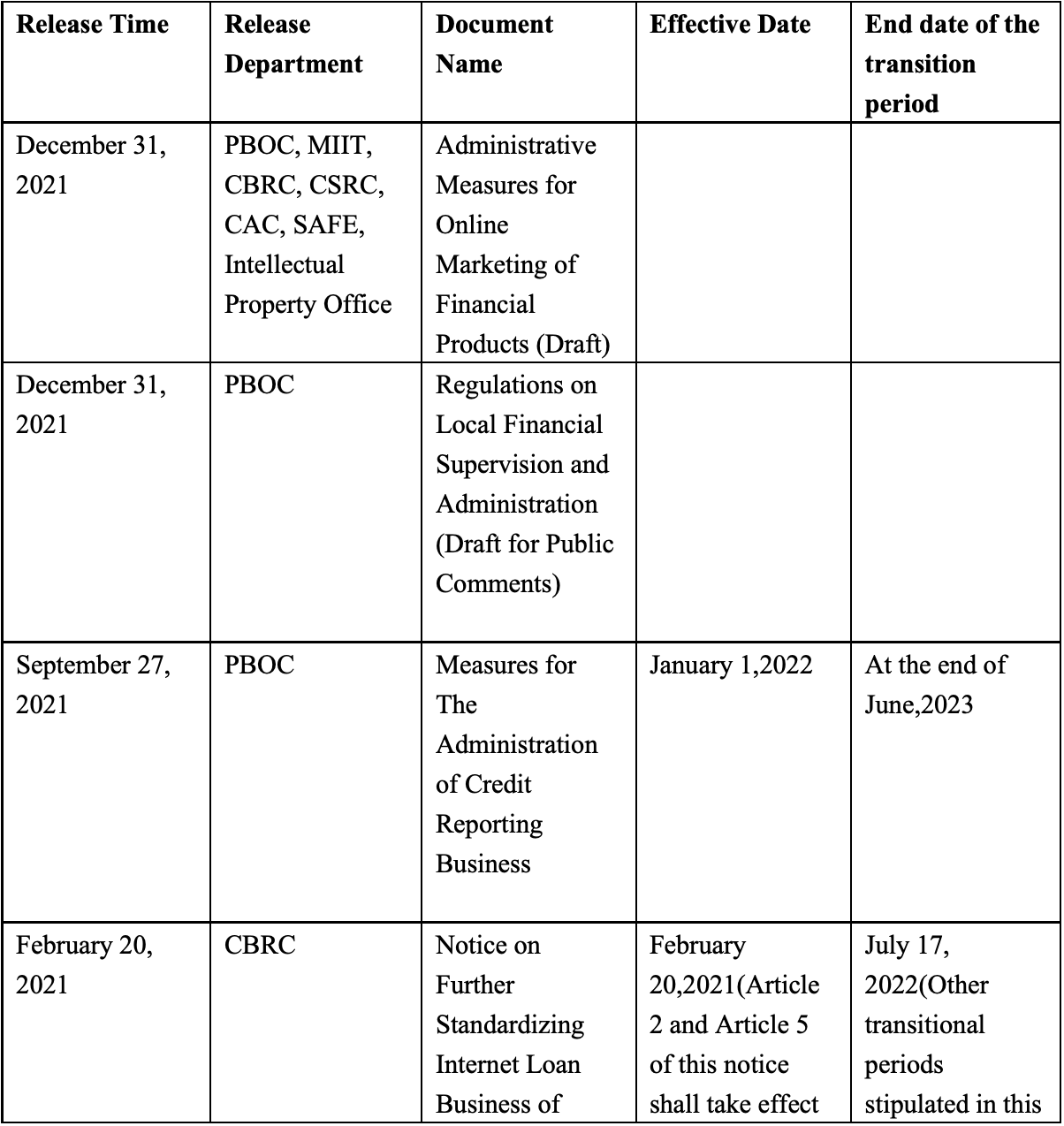

In 2020 and 2021, laws and regulations for credit reporting business, financial institutions and internet platforms have been intensively introduced. Most of the key laws and regulations will come into effect after the transition period ends in 2022 or early 2023, which requires all the Fintech participants to comply to these laws and regulations in 2022.

Data source: FinTell analysis

l Credit Reporting Business: compliance, centralization, and marketization

New regulations on credit reporting require the output of financial industry data to be rerouted and more compliant. With the approval of Baihang Credit, Pudao Credit, Qiantang Credit and potentially more credit reporting companies down the road, market-oriented credit reporting services will become more centralized, secure, and efficient. Of course, the market competition among credit reporting companies will inevitably occur.

l Financial Institutions: independent operations and risk management

The series of laws and regulations carried out for commercial banks explicitly require financial institutions to reasonably divide the boundaries of internet loans. Financial institutions are required to fully establish independent risk management and self-operating capabilities, and reginal commercial banks are required to operate locally. There are three red lines such as the proportion of capital investment, business concentration and exposure limitation.

There are also more prudent requirements for the national expansion and leverage ratio of online small loans, financing guarantees and other financial institutions previously approved by local financial regulators. As for product pricing, it is understood that in the second half of 2021, many financial institutions have received window guidance from local financial regulatory authorities, requiring that the loan interest rate should not exceed 24%. The transition period is one year.

l Internet Platform Companies: finding new ways to cooperate

For the supervision of Internet platforms, the gradual transitioned from "interview" to the substantive introduction of management methods is observed. The Central Bank, the China Banking and Insurance Regulatory Commission and other departments jointly held interviews with 13 Internet platforms, directly restricting their businesses such as account acquisitions, loan assistance and joint loan to a certain extent. Platforms are required not to directly provide financial institutions with information voluntarily submitted by individuals, information generated within the platform or information obtained from outside in the name of application information, identity information, basic information, personal portrait scoring information, etc. At the same time, a specific way of "cutting off the direct connection" with licensed financial institutions is also a hot topic of continuous discussion in the industry. It is understood that it will also likely be implemented in 2022.

The Measures for the Administration of Online Marketing of Financial Products (Draft for Solicitation of Comments) issued near the end of the year clearly requires that non-licensed third-party Internet platforms should not operate in a “profit-sharing” mode for providing customer acquisitions to licensed financial institutions, and restrict and standardize internet platforms in the marketing, promotion, and sales of financial services.

Under the regulatory requirements, the platform companies need to find new ways to cooperate with all parties, and to meet existing and upcoming laws and regulations. Meanwhile, how to effectively protect their own benefits is a key consideration for platform companies while they explore more innovative ways to collaborate with all parties.

New industry trends in 2022

The new trend of the industry is the inevitable evolution under the laws and regulations of the industry supervision, and the embodiment of the supervisors’ intention to have a sustainable fintech industry. The following are the likely new trends:

l Compliant operations that fulfill respective duties, and a diverse ecosystem where participants communicate and complement each other

The strengthening of supervision is not to limit the development of the industry, but to guide its healthy development. Under the new regulatory environment, there will be a compliant operation characterized as "finance returns to finance, technology returns to technology, credit reporting returns to credit reporting, and acquisitions returns to acquisitions". In another word, participants should refocus on their defined roles and what they are most capable of. The new operation mode spans across the whole industry and all business dimensions.

However, such compliant operation is not completely independent and fragmented, but mutually complementary to form a diversified ecosystem. Licensed financial institutions, third-party Fintech companies, credit reporting companies and acquisitions platforms will be deeply involved in this ecosystem and contribute to the healthy development of Fintech.

l Healthy competition drives innovation breakthroughs, and resource integration accelerates capability differentiation

Under the new Fintech landscape mentioned above, the various roles are interconnected and complementary. However, in their respective fields, due to the large number of participants, competition is expected to be fierce. The competition in financial business will be carried out among licensed financial institutions. Big state-owned banks, joint-stock banks, urban commercial banks, consumer finance companies, and other licensed financial institutions will have increased competition in credit business. Those who provide technical services, credit reporting services and acquisitions for licensed financial institutions will also compete in the same market to serve the financial institutions.

To stand out in the fiercely competition, one must continue to innovate and bring more efficient and value-for-money services to customers.

For licensed financial institution, whoever can strengthen business development and invest in technology, leverage third-party financial technology companies/credit reporting companies/acquisition platforms, and effectively integrate resources, will win a larger market share in the new era of Fintech, achieving "Matthew effect", and widening the gap with its competitors.

l The "increased quantity and improved quantity" of inclusive finance, and the decreased cost in social financing

Coordinated supervision to construct financial laws and regulations and strengthen the application and management of Fintech will help create a sound financial environment, promote inclusive finance, and reduce social financing costs. The core of inclusive finance lies in " increased quantity and improved quality".

In terms of increased quantity, supervision aims to guide licensed financial institutions to build the capability of financial inclusion and to serve more customers at a lower cost, especially high-quality customers.

In terms of improved quality, supervision aims to optimize the financial supply structure, realize more accurate supply of financial resources, pay more attention to technological innovation in financial services, and provide high-quality services to high-quality users. Improved quality is reflected in higher service efficiency and lower service costs.

Recommendations for key participants in 2022

l For financial institutions

The transition from loan assistance model to self-operating businesses and independent risk management will strengthen financial institutions in the areas of customer acquisitions, data and system capabilities, risk management, operations etc. In addition to talent cultivation and system development, it is also necessary to cooperate with platform companies, credit reporting companies and third-party Fintech companies with an open mind to promote the transformation of its decision-making system from "data element gap filling” to "value-driven capability enhancement” based on compliance.

In terms of decision-making system, financial institutions should transform and upgrade from "risk-based or volume-based" to "customer value based” and implement real-time asset quality monitoring and risk warning as risk assets expand.

l For credit reporting companies

After the establishment of People's Bank of China credit reporting, Baihang credit, Pudao credit, Qiantang credit and other potential credit reporting companies, the credit bureau market will also usher in a diverse credit bureau data era.

By strengthening in-depth cooperation with third-party Fintech companies, these market-oriented credit bureaus can rapidly improve and enhance data mining and product building capabilities, realizing the full value of credit reporting licenses, integrate and deploy market resources, and steadily develop traditional credit data. While accumulating traditional credit reporting data, credit reporting companies can develop alternative personal credit data such as mobile device data, e-commerce data, operator data, etc., quickly forming product and service features, and eventually establishing brand advantages in the competitive environment. The dual developments above will lead to enhanced professional credit reporting service ability and continuous improvement of the social credit system.

l For internet platforms

In the new era, the previous "strong risk management engagement" model requires significant adjustments, making it more difficult to match loans with suitable fund resources. Platforms need to further clarify the role in credit business, focus on "customer targeting", support the returning of risk management responsibilities to financial institutions, andimprove the value-based customer segmentation in acquisition services. Through effective matching of loans to fund sources, internet platforms can help establish industry wide risk management principle of “risk-based pricing and risk-based line assignment”.

In this context, while constantly improving its own products and technical capabilities, platforms are also facing challenges in multiple fronts: improving the matching efficiency with suitable funds, improving its own asset quality and product capabilities. Third-party fintech institutions have lots of experiences in data, technology application and financial knowledge. Together, they can better help financial institutions develop credit business and provide customers with better service experience.

l For third-party Fintech participants

Adhering to technological innovation is the key. Only by maintaining the commitment to artificial intelligence, big data, and other fields of technology, maintaining the awe for financial discipline, increasing investment in R&D and acquiring technical talents, can one remain vibrant in the fierce competition.

In addition to maintaining technological innovation, Fintech institutions also need to continuously broaden their ecological boundaries, establish in-depth cooperation with credit reporting companies, licensed financial institutions, internet platforms, and continuously promote the compliant development of data business, improve the efficiency of credit business operations, and reduce operating costs.

Fintech companies should seek cooperation in competition, help regulators establish the risk management and technical standards required by a developed financial system, and contribute to the healthy development of the Fintech industry in China.

Thank you!